To achieve long-term investment returns through capital growth, by investing primarily in equity securities of Canadian issuers.

Minimum Initial Investment:

Lump Sum

Initial: $500

Subsequent: $100

| Front-End Load Option | ATL1023 |

|---|---|

| Back-End Load Option | - |

| Low Load Option | - |

| Closed to all purchases | |||||||||

| Front-End Load Option | - | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Back-End Load Option** | ATL1123 | ||||||||

| Low Load Option** | ATL2123 | ||||||||

| Inception Date | Sep 26, 2011 |

|---|---|

| Fund Code | ATL1023 |

| Assets Under Management ($000) As at : 03/28/2024 | $256,786 |

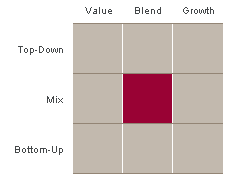

Style

| 3 mo | 6 mo | YTD | 1 yr | 3 yrs | 5 yrs | 10 yrs | Since Inception |

|---|---|---|---|---|---|---|---|

| 7.0% | 14.7% | 7.0% | 15.1% | 7.1% | 8.8% | 5.3% | 6.5% |

As at: 03/28/2024

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|

| 9.2% | (6.9%) | 19.2% | 5.70% | 26.1% | (12.7%) | 8.2% | 11.8% | (7.5%) | 4.8% |

Value of $10,000 invested since inception

The rate of return or mathematical table shown is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the fund or returns on investment in the fund.

†The management fee has changed effective September 1, 2016. The management expense ratio (MER) for the financial year ending August 31, 2017 will be based on the total expenses of the Fund for that financial year (excluding commissions and other portfolio transaction costs). The Manager may waive and/or absorb management fees and operating expenses at its discretion. The practice of waiving and/or absorbing management fees and operating expenses may continue indefinitely or may be terminated at any time without notice to unitholders.

†Please refer to the Annual/Interim Management Reports of Fund Performance for further details.

**Effective May 13, 2022, all deferred sales charge (referred to as DSC) purchase options (i.e. back-end load and low-load options) are closed to new purchases, including purchases through pre-authorized chequing plans. Switches to units of another Fund managed by CIBC Asset Management Inc. under the same DSC purchase option will continue to be available.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Renaissance Investments family of funds simplified prospectus before investing. The indicated rates of return are the historical annual compounded total returns for the class A units including changes in unit value and reinvestment of all distributions, but do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed. The values of many mutual funds change frequently. Past performance may not be repeated.